TAEF Annual Report

Board Chair and COO Letter

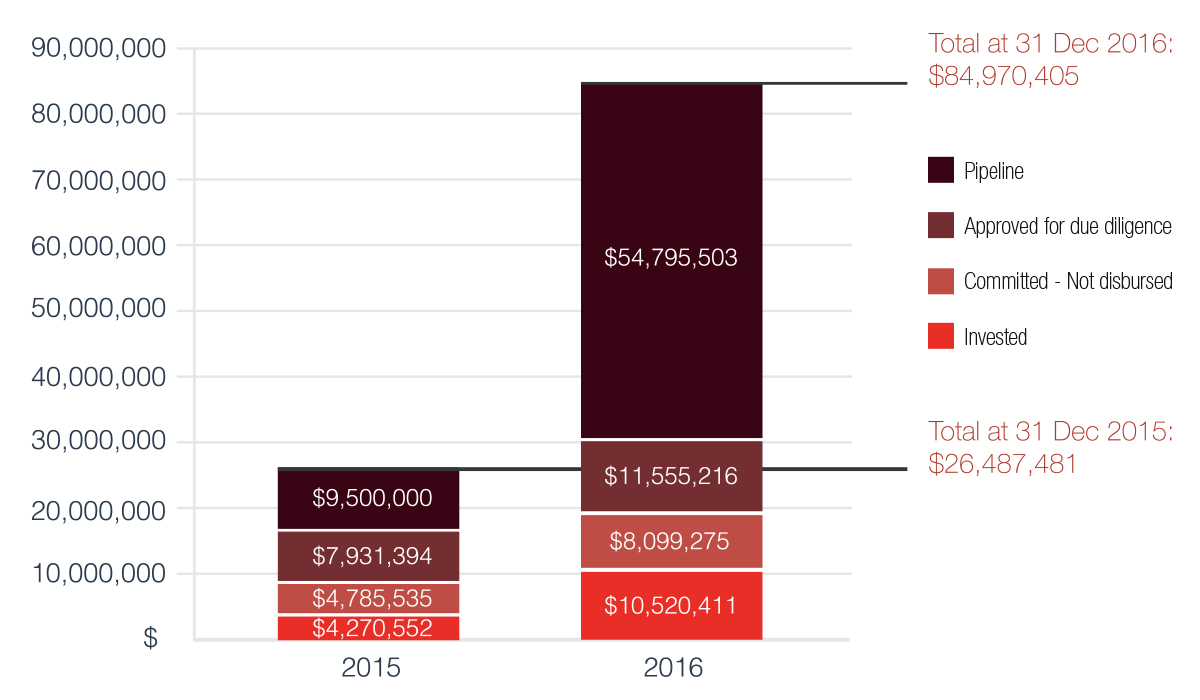

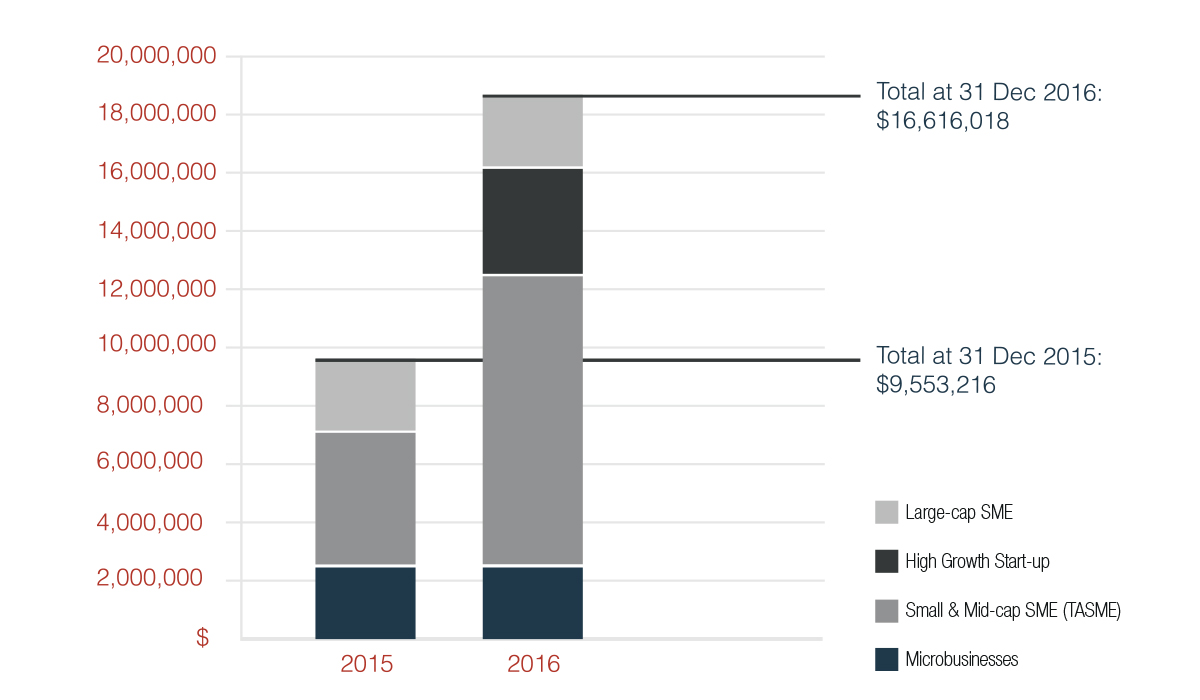

Hela and I want to reemphasize again how pleased we at TAEF are about our progress and about the dynamism and energy displayed by the entrepreneurs we’ve invested in. And at the same time we want to underline something that isn’t always apparent. All of our investments are intended to reach different parts of the small and medium enterprise sector in Tunisia and all of these investments are driven by the same belief.

We believe that the health and growth of this SME sector is the key to a healthy Tunisian private economy.

If we wish to see stronger Tunisian economic growth, more jobs, greater equity and fairness, more opportunities for Tunisia’s youth, and more possibilities in all parts of Tunisia, then there is no other path but to develop the SME sector.

As TAEF grows in the future we will create more and different ways to invest in this sector, but our single minded focus on the health of small business and the value to Tunisia of Tunisia’s own home grown entrepreneurs will not change